It is difficult to overstate the impact of fossil fuels on the modern world. Coal and petroleum, in particular, have shaped everything from transportation infrastructure to the industrial sector to even the materials from which everyday objects are made. Petroleum and its byproducts are critical constituents in nearly all the physical goods that populate the world today.

Fossil fuels are also critical for the elevated standard of living people enjoy today relative to the past. As Vaclav Smil put it in his 2022 book How the World Really Works, the “average inhabitant of the Earth nowadays has at their disposal nearly 700 times more useful energy than their ancestors had at the beginning of the 19th century.”

Doing so required the extraction and combustion of something like 1.3 trillion barrels of oil since it first began to be commercially drilled in the United States in 1859. Today, the world burns roughly one cubic mile of oil each year.

But while the benefits of fossil fuels have been tremendous, oil is becoming increasingly complicated to produce. The energy and cost basis of extracting it is rising domestically, while global oil markets face rising costs due to increased demand from rapidly industrializing and developing nations like China.

The history of humanity can be seen as a migration toward more powerful types of fuels. From lumber, to coal and now oil, each new fuel era has helped us massively scale up the amount of work we can do. The oil age ushered in an era of unprecedented ability with jets that can fly around the world and over a billion cars on the road, alongside a massive expansion in industry. Despite being the most energy-dense combustible fuel we’ve encountered, fossil fuels are also still relatively plentiful, with immense infrastructure put in place to transport them.

Still, the challenge of weaning ourselves off of oil is one that has haunted us for a long time. Outside of being an inherently finite resource, combusting fossil fuels has also resulted in an unsavory terraforming of the Earth, as the 280 gigatonnes of carbon we’ve added to the atmosphere since the dawn of the oil age raised average temperatures around the world.

Alternative fuels have been explored as a potential substitute, but nothing comes close to oil. The growth of renewables as a primary energy source has been encouraging, but it is butting up against an electric grid ill-prepared for supporting distributed energy generation and the reality that many critical activities, like air travel, shipping, and heavy industry are not so easily or economically electrifiable. Designing a solution out of fossil fuel dependence, while possible, will be complicated.

The Present Oil Age

In terms of weight, energy density, and ease of transportation, oil is the most efficient and economical fuel we have. Not only has it shaped global transport, fueling over 1.4 billion vehicles, but it has completely reinvented how we dress, manufacture goods, and eat. It has also single-handedly reorganized global politics.

Much of the global political equilibrium is dependent on who controls and produces this commodity. It is assumed that global oil reserves amount to something like 2.39 trillion barrels. In total, there are something like 50,000 oil fields in the world, though the vast majority of the world’s oil is located in just a handful of these. There are 40 oil fields that are considered “supergiants,” meaning fields with a reserve of over 5 billion barrels. Fifteen of the oil-producing countries in the world control over 90 percent of global oil reserves; chief among them are Saudi Arabia, the United States, and Russia.

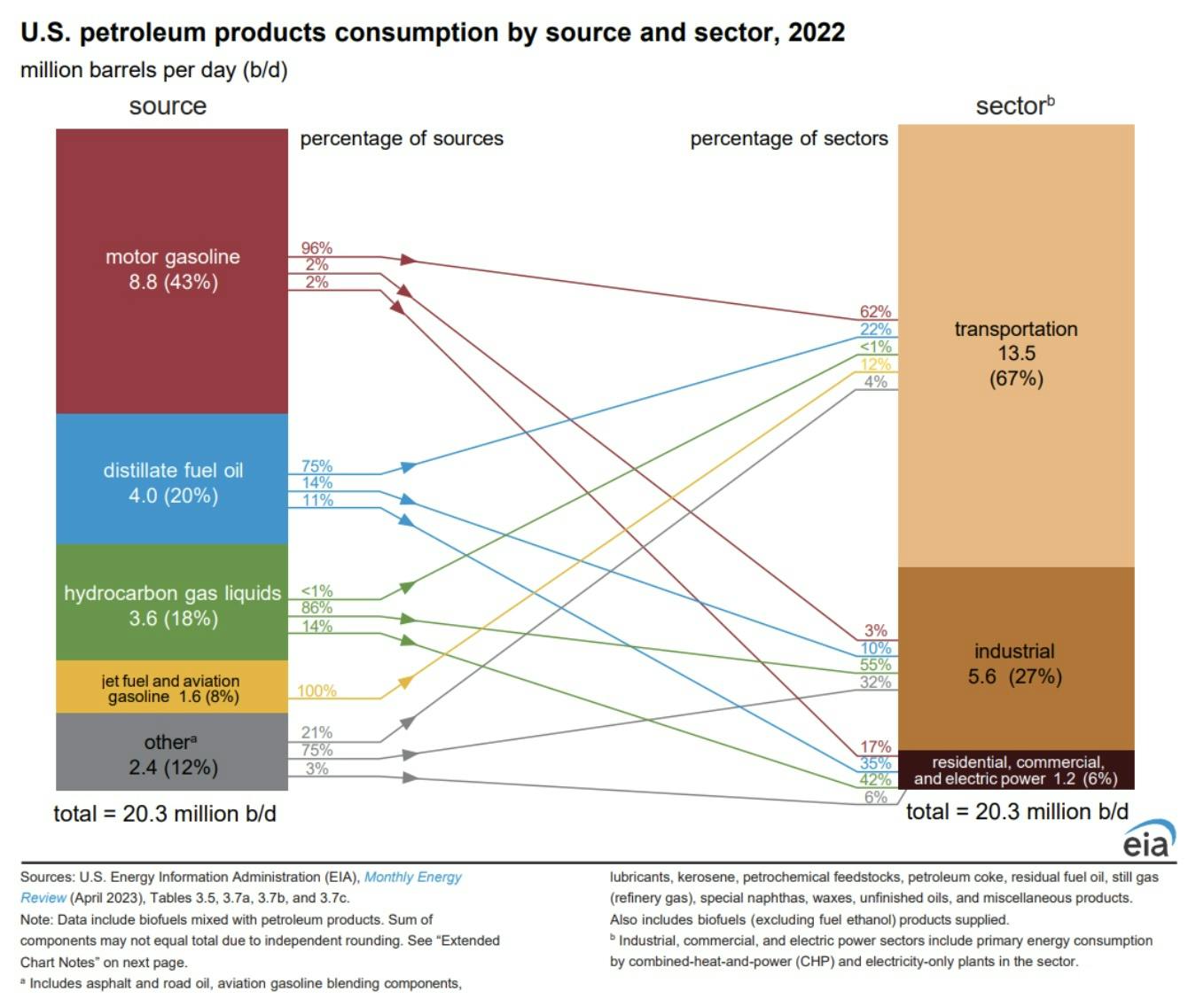

The United States is the world’s largest consumer of petroleum, consuming some 20.28 million barrels per day as of 2022. Once extracted, petroleum is refined into a number of petroleum products, the most significant of which is gasoline. 43% of the annual petroleum supply goes into making gasoline, which is primarily used to power motor vehicles.

Next is diesel, produced from 20% of the petroleum supply. Diesel is used to power heavy freight and industrial or remote generators. After that come hydrocarbon gas liquids, some of which are produced from petroleum, but the vast majority of which come from natural gas. Hydrocarbon gas liquids are things like ethane, propane, butane, ethylene, and propylene, which can be used for heating and cooking, but are largely used as industrial inputs to produce various polymers like polyester fibers and other plastics. Finally, 8% of annual petroleum production goes toward jet fuel which powers air travel.

Source: US Energy Information Administration

The United States is also the world’s largest consumer of natural gas, using 32.31 trillion cubic feet of it per year. Most of this goes toward electric power generation — as of 2022, natural gas generates 33% of the energy generated in the US — followed by industrial use cases like the production of polymers, and residential heating.

This high-level picture demonstrates the degree of our reliance on fossil fuels. Thus, as questions of weaning ourselves off of such fuels become a more critical issue, the magnitude of this challenge has come into stark relief. While there have been serious efforts made in electrifying many of these activities, notably in vehicle transport, not all critical activities are as easily electrifiable.

Air travel, freight shipping, and heavy industries, which include cement, steel, and petrochemical production, collectively account for roughly 30 percent of global CO2 emissions. These industries are notoriously difficult to electrify as they require the creation of tremendously high heat for extended amounts of time. Though it is theoretically possible to make these processes electric, practically it is extremely uneconomical to do so.

Designing a solution for how we will generate the energy required to sustain all of these activities without fossil fuels will likely involve a tapestry of different workarounds. To better understand the stakes and the potential solutions on the table, let’s begin with a history of our long-standing relationship with fossil fuels.

Our History With Fuels

Fossil fuels are formed over millions of years as plant and animal life decompose into the earth and become sediment. In time, this sediment hardens and becomes sedimentary rock. As this process repeats itself for thousands of years, the sedimentary rock is effectively cooked under the increasing pressure and heat it encounters below the earth. At depths of around 750 to 4800 meters, the hardened organic matter becomes petroleum.

From deep beneath the earth, where pressures are immense, liquid petroleum will migrate to whatever regions of lower pressure it can find. It may eventually find itself in instances of porous rock, or shale. In some cases, it even finds its way to the surface of the earth and seeps straight out of the ground.

Source: Envirotec Magazine

It was in this state that oil was first discovered by ancient civilizations thousands of years ago. The Babylonians were known to have used bitumen, a thick and hardened version of petroleum, as asphalt. In fact, there are myths that they used it to waterproof the insides of the underwater tunnels they are said to have built. Elsewhere, Persian armies dipped their arrows in petroleum to launch fiery barrages in war.

Among fossil fuels, it wasn’t just petroleum that seeped up to the surface Natural gas, formed via the same process, could seep up to the surface, and produce a powerful blaze, seemingly out of nowhere, when ignited. These gaseous springs became a thing of legend called “burning springs.”

Digging or shoveling was the best solution to excavate these combustible resources from their source beneath the earth. However, only small amounts of petroleum could be recovered this way. Oftentimes, the source of petroleum seeping from the ground is hundreds if not thousands of meters below the earth, buried underneath hard rock that was simply not possible to displace. Without being able to recover it in large quantities, petroleum was mostly used in limited circumstances for its material properties. It was particularly useful for setting jewelry or as a coating that could seal wounds.

As a result, for most of human history, the primary combustible fuel was lumber. Lumber was a great source of heat for a hearth or a blacksmith’s forge, while more industrious activities, like milling grain or pressing oil, were powered by flowing rivers or animals.

The difficulty with lumber was that it was not just used as a fuel, but also as one of civilization’s main construction materials. As Europe’s population expanded, its forests were gradually destroyed. Around the 16th and 17th centuries, Europe’s forests were effectively eliminated.

It was at this point that serious efforts were taken to expand the production of an alternative fuel source — coal. Europeans had known about the existence of coal since the 13th century. It was lighter, burned hotter and for longer than lumber, but it was mostly confined to use by specialty trades like blacksmiths until the 1600s. In How The World Really Works, Vaclav Smil estimates that coal first surpassed biomass fuel as a heat source around 1620, and by 1700 it supplied 75 percent of all humanity’s heat.

It was really the beginning of the Industrial Revolution, the expansion of heavy industry like steel production, and the invention of machines capable of doing work — like the steam engine – that produced an expanded role for coal to play. Coal production ramped up exponentially, and soon, was everywhere.

Source: Our World in Data

Despite taking over the world, there were certain inconveniences associated with coal. Firstly, it was heavy and difficult to transport. Secondly, it was not a terribly efficient fuel to burn. Certainly, it was superior to lumber in this respect. However, the total work that can be recovered from coal after it is burned to produce steam to power an engine is around 2 percent. This meant that steam-powered locomotives would be carrying around a great deal of excess weight, the vast majority of which would not be converted into pushing the train forward.

Discovering how to extract the fuel that would eventually replace coal from underground came as an accident. It happened in 1802, in American West Virginia, just as the usage of coal was taking off.

The Ruffner Brothers, who were engaged in the salt trade, were innovating on a new technique to extract brine from below ground. Extracting salt from brine was a simple process, but extracting brine from deep subterranean wells was rather challenging. The standard technique was digging a well, but the Ruffners wondered if it would be possible to drill instead.

They came up with a clever spring pole technique. This worked by using a flexible wooden pole, anchored at its base. When the driller pushed down on the pole, bent it, and then released it, the stored energy caused the pole to spring back. This motion was harnessed to rotate a drill bit attached to the top of the pole, allowing the well to be drilled deeper and deeper by repetitive pushing and releasing actions.

Source: Dangerous Laboratories

After 18 months of drilling, the Ruffners’ well reached 58 feet deep, from which they extracted copious quantities of salty brine. The drilling technique stuck and was soon adopted by many in the salt business.

Sometimes, petroleum would leak into the collected brine. Some would separate it and find small markets to sell it into. At the time, petroleum was still considered as little more than a lubricant, and, strangely, a medicine.

After 1855, however, drillers would come to realize the true value of the oil they’d been siphoning away. George Bissell, an entrepreneur from New Hampshire, had a hunch about the true potential of petroleum. He thought it might be a possible substitute for whale oil, or highly distilled “coal oil,” both of which were used for illumination. He wrote to Yale chemist Benjamin Silliman Jr. who, in 1855, confirmed that petroleum could be distilled into a high-quality illuminant called kerosene. Bissell formed the Pennsylvania Rock Oil Company shortly thereafter. It was the first petroleum company in America, and it kicked off the Oil Age.

Countless rigs, employing an amended version of the Ruffners design with steam-powered cable tools drilling into the earth and reinforced by wooden derricks, cropped up all across the Appalachian Basin which ran beneath Pennsylvania, West Virginia, and Ohio.

Source: Penn State

In these states, the soft soil was conducive to cable rig drilling, but going deeper proved challenging as drills were incapable of breaking and penetrating dense rock strata.

In 1901, in the small Texas town of Beaumont, a new kind of drill was implemented. It was a rotary drill that used torque to crush up rock as opposed to the top-down force used by cable rigs. The drill was deployed at a rig set up at Spindletop Hill, and when the drill bit finally struck oil, a gigantic 150-foot gusher exploded out of the Earth.

Source: American Petroleum Institute

It was the beginning of a gold rush. Within months, the population of Beaumont tripled. Within a few more months, thousands of companies moved in to start drilling too. The next year, Howard Hughes Sr. (the father of Howard Hughes Jr., the eccentric Los Angeles-based billionaire who later started an aerospace company that would invent the laser) produced a two-cone drill bit, which was much more effective at crushing hard rock. His firm, the Sharp-Hughes Tool Company, would go on to sell these rotary bits to most Texas oil prospectors, a new type of shovel for a new type of gold rush. When Howard Hughes Jr. inherited the company after his father’s death, the company’s drill bits were being used on nearly every rig in Texas, making Hughes Jr. the richest man in the world in the 1950s.

To extract the petroleum from below ground, the sides of the borehole were reinforced with pipe. If the well was fresh, petroleum would normally come rising up to the very top, escaping the areas of high pressure underground. This phase of oil recovery, called primary recovery, normally delivers about 10 percent of the reservoir’s total oil to the surface. After this, the pressure in the reservoir drops, and oil no longer rises readily to the surface.

Secondary recovery techniques involve building parallel access points to the reservoir which inject water or gasses to increase pressure and force more oil to come out. These secondary techniques will help remove 20 to 40 percent of the total oil in the reservoir. However, beyond this, more elaborate techniques are required to remove the remainder of the petroleum. These are called enhanced recovery techniques, and they are necessary at all drill sites that have extracted all easily accessible oil, which is the case at most oil fields in the US.

There are numerous enhanced oil recovery techniques, however, the most common one involves injecting carbon dioxide among other gasses into the reservoir to increase pressure and lower the viscosity of the oil so it flows more readily up to the surface. Enhanced oil recovery is currently the largest market for carbon captured from heavy industries, oil refineries, and power plants. Enhanced oil recovery currently makes up for only 2% of the total global supply of oil, but it’s indicative of a trend toward more complex methods of extraction now that so-called “conventional oil” supplies have largely been tapped in North America.

Source: Council on Foreign Relations

American oil production reached a peak around 1970, and gradually began falling until new techniques became popularized to extract oil from “unconventional” sources. Two main innovations came into play. The first was a series of improvements in horizontal drilling, which allowed engineers to steer a drill bit sideways into a formation. Many oil formations were trapped in long, thin reservoirs not easily accessible by a vertical pipe. Horizontal drilling allowed for the extraction of these types of oil deposits.

The second was hydraulic fracturing, or fracking, which aimed to extract natural gas out of shale rock. Shale formations harbored pores within which natural gas was stored. However, extracting sufficient quantities of gas was not possible with conventional vertical drilling techniques. Instead, methods of injecting pressurized fluids to crack the shale and create pathways for the natural gas to escape were developed and hugely improved during the 1990s. The Institute For Progress’s Brian Potter has a terrific explainer detailing the history and technical details behind this revolution.

Source: Utah Geological Survey

Together, these innovations have allowed the United States to produce roughly 75 percent of its oil supply and 90 percent of its natural gas supply as of 2022.

Other unconventional extraction techniques include those used in the Canadian oil sands, where oil is mixed in with sand in a kind of sludge. Similarly to enhanced oil recovery techniques, steam is injected into the oil sands which increases the viscosity of the oil allowing it to flow to the top. An alternative technique used in Canada is simply open pit mining, for reservoirs that are less than 75 meters below ground. The sands are loaded into trucks where they are transported to refineries to have the sand removed and be distilled further.

Perspectives on the Future of Fuels

Contemporary techniques for extracting oil and natural gas now are much more involved than drilling a vertical hole and waiting for the fuel to rush out. Much more investment and energy is required to produce the same amount of oil today as it would have produced 50 years ago.

This is apparent even just by looking at the energy return on investment (EROI) of oil, a ratio that indicates the amount of energy produced over the amount of energy spent. At the dawn of the Oil Age, the EROI on oil was something like 100:1, meaning roughly that one barrel of oil consumed could unlock 100 barrels worth of production. By 2023, that number falls somewhere between 4:1 and 30:1 depending on where the oil is extracted.

This increased energy investment is reflected in the steadily climbing structural cost of oil, which up until 2005 fluctuated around $15 a barrel since the 1970s. 2005 is when the production of “conventional oil” plateaued, finally beginning a steady decline in 2019. From then until 2024, the average price for US crude oil has hit an average of $90 per barrel. Certainly, other factors like increased demand have played a role in this price action, but a scenario of increased demand alongside steadily declining readily accessible supply is telling.

Source: US Energy and Information Administration

Of course, the rising cost of oil and concern over its eventual depletion are not the only issues. Chief among fossil fuel anxieties is their adverse impact on the environment. Though the United States is not the world’s largest polluter, it is the world’s largest consumer of petroleum, consuming roughly 20% of the global petroleum supplies, ahead of China, which consumes roughly 16% as of 2022.

Furthermore, the appetite for combustible fuels has shown no signs of diminishing, with annual consumption rates remaining relatively flat since the beginning of the 21st century. With the vast majority of petroleum products like gasoline, diesel, and jet fuel servicing the transportation and industrial sectors, there have long been calls for an exploration of alternative fuels that could replace petroleum-based ones.

Two alternative solutions in particular have been explored at length, including biofuels, like ethanol and biodiesel, and hydrogen fuel. Ethanol is essentially alcohol and it’s made by fermenting any kind of crop high in carbohydrates, like sugarcane or corn, whereas biodiesel is made by combining ethanol with some kind of animal fat or vegetable oil. Interestingly, in 2005, the same year when conventional oil production began to plateau, the federal government created a program called the Renewable Fuel Standard (RFS) which insisted that American oil refiners blend ethanol with gasoline production. Today, nearly all gasoline in the US contains a mixture of 10% ethanol to 90% gasoline.

This has some beneficial properties, including increasing the gasoline’s octane number, which determines how smoothly an engine combusts its fuel. Outside of this, the goals of RFS included reducing emissions and decreasing reliance on other countries for oil. The outcomes of the policy, however, have been mixed. In its wake, 7 million additional acres of land were added to grow corn to supply this ethanol, resulting in 40% of American corn production being directed toward ethanol production.

An article from Yale’s School of the Environment, however, points out that not only did mixing ethanol with gasoline decrease gas mileage, since ethanol contains 30% less energy than gasoline, it also resulted in a higher price for corn. Furthermore, the EROI of producing ethanol from corn hovers somewhere around a ratio of 1:1, if not lower, implying that we may be spending more total energy on farming the corn and producing ethanol than we actually get out of the fuel, whereas at the end of the day, it’s a fuel that’s still going into combustion engine vehicles that emit greenhouse gasses.

While ramping up ethanol production has widely been considered a mistake, a slightly more promising alternative fuel is hydrogen. Liquified hydrogen is already used as a propellant in rockets because of its high specific impulse. For the same reason, hydrogen combustion is capable of burning very hot for a long time, which makes it a legitimate fuel to power certain industrial processes like steel or glass production, which require temperatures up to 2000°C. Doing so would require retrofitting such plants to be able to run on hydrogen which analysts at Columbia have suggested would be a relatively straightforward process. Airline companies like Airbus are at least nominally suggesting that hydrogen-powered flight might be a possibility in years to come, and startups like Universal Hydrogen are envisioning ways that a hydrogen fuel supply line might work. There even exist heavy-duty and passenger vehicles equipped with fuel cells capable of converting hydrogen and oxygen into electricity. Hydrogen burns clean and releases water as a byproduct.

The problem lies in the actual production of the hydrogen gas. Hydrogen does not exist in a pure form, and thus the two main ways of making it involve electrolyzing water into hydrogen and oxygen gasses, or extracting it from natural gas. As of 2023, 80% of all hydrogen is produced from natural gas. While this is not a problem in itself, what is a problem is that the EROI of hydrogen production is not efficient at all. Current processes yield between a quarter or a fifth of the energy invested in harvesting the hydrogen, and until this improves, the hydrogen economy will likely be a non-starter.

It is clear that transitioning away from a fossil fuel-based economy will require a plethora of involved and complicated solutions. For applications like transportation, which already has a number of electric solutions, additional work will be required to produce an electric grid that is capable of sourcing electricity from distributed sites and directing it to a large and growing number of electric vehicles. For processes that require the continued use of combustible fuels, like heavy industry, mitigating measures like carbon capture will be needed to decrease the long-term impact on the climate.

Disclosure: Nothing presented within this article is intended to constitute legal, business, investment or tax advice, and under no circumstances should any information provided herein be used or considered as an offer to sell or a solicitation of an offer to buy an interest in any investment fund managed by Contrary LLC (“Contrary”) nor does such information constitute an offer to provide investment advisory services. Information provided reflects Contrary’s views as of a time, whereby such views are subject to change at any point and Contrary shall not be obligated to provide notice of any change. Companies mentioned in this article may be a representative sample of portfolio companies in which Contrary has invested in which the author believes such companies fit the objective criteria stated in commentary, which do not reflect all investments made by Contrary. No assumptions should be made that investments listed above were or will be profitable. Due to various risks and uncertainties, actual events, results or the actual experience may differ materially from those reflected or contemplated in these statements. Nothing contained in this article may be relied upon as a guarantee or assurance as to the future success of any particular company. Past performance is not indicative of future results. A list of investments made by funds managed by Contrary (excluding investments for which the issuer has not provided permission for Contrary to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at www.contrary.com/investments.

Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by Contrary. While taken from sources believed to be reliable, Contrary has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Please see www.contrary.com/legal for additional important information.